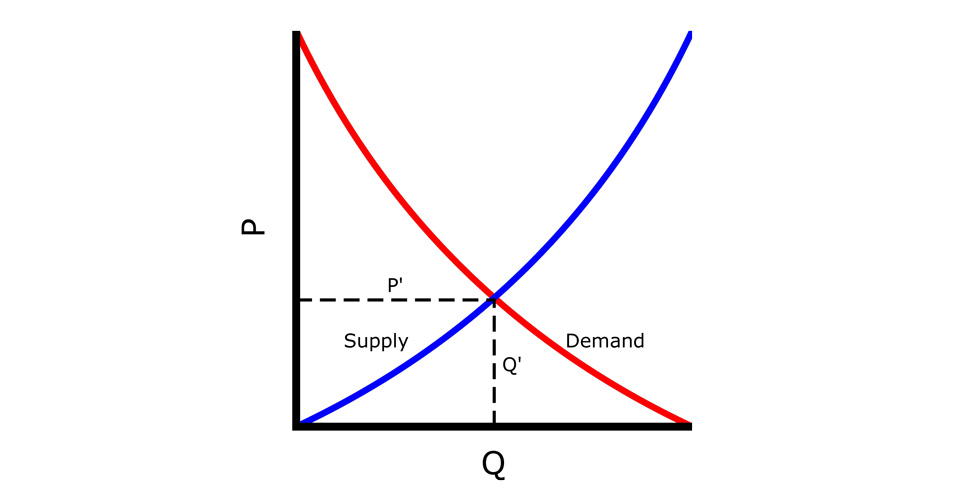

As mentioned in the previous blog post, the S&P Case-Shiller Index offers a trustworthy barometer of the U.S. housing market. However, there’s more than one way to estimate price direction in the USA housing market. Like anything, home prices follow the law of supply and demand.\r\n\r\nSo for a moment, forget real estate, and let’s think economics. Supply and demand is a fundamental principle in economics, where supply refers to the amount of a certain product available, and demand refers to the desire of consumers to purchase said product. Price is simply a reflection of this relationship. If supply of a product is higher, prices go down. If demand is higher, prices go up.\r\n\r\nSo how does this actually apply to housing prices? Well, it’s simply a matter of assessing the number of homes being built, compared to the number of homes being purchased. If more homes are being built than sold, supply is rising, demand is falling and prices will inevitably fall with it. Conversely, if more homes are being purchased than built, then supply is dwindling, demand is rising, bringing price with it. As such, the current supply of homes on the market can be a reliable indicator of the price direction of home prices in the near term. Typically, if we have six months of inventory, prices will remain stable. More than six months of inventory lead to a fall in prices while less than six months of inventory lead to prices increasing.\r\n\r\nWe can see this historically in the timeline of the real estate bubble of the early 2000’s. From around 1997 until 2005, we saw a large increase in home purchases. Demand was higher than supply, and prices rose. Then from around 2007 until 2011, buying slowed, supply overtook demand and inevitably, prices fell. Then from around 2012, buying overtook the available inventory, demand increased and prices began to rise again.\r\n\r\nSo, let’s get back to our original question… Based on the current inventory of homes, will prices rise, or will they fall? Right now, we are looking at about 5.7 months of inventory, meaning that prices should gradually continue to rise into 2016.\r\n\r\nThe predictions we can make regarding home prices seem to dovetail with the predictions made by the Case Shiller index. The agreement in the two different ways to predict home prices allows us to feel confident our predictions of the movement in home prices.

Using Supply and Demand to Predict Home Prices